Healthcare Planning

Life is meant to be lived; cherish the exciting moments, and relish in those all too brief moments of relaxation.

As the oldest baby boomers begin to wind through their 70s, one of the biggest concerns may not be outliving income but outliving good health. Who will take care of you if you are unable to care for yourself?

Medicare provides a certain level of coverage for your medical expenses, but it won’t cover all expenses. To bridge this gap, Medicare supplement insurance plans are designed to help you cover certain charges, or “gaps,” that Medicare doesn’t cover, such as copayments, deductibles, and coinsurance costs. These charges can add up quickly during sudden or unexpected illnesses. Supplemental insurance covers expenses not included in Medicare Part A and Part B, such as acupuncture, chiropractic services, dental care, eye exams, hearing aids, travel, and prescription drugs.

Anyone eligible for Medicare and enrolled in Part A and Part B may consider supplement insurance. Even if you are in good health and believe that standard Medicare will provide the coverage you need, it may be wise to purchase supplemental insurance. If your health status changes, your ability to enroll for supplemental insurance may be compromised.

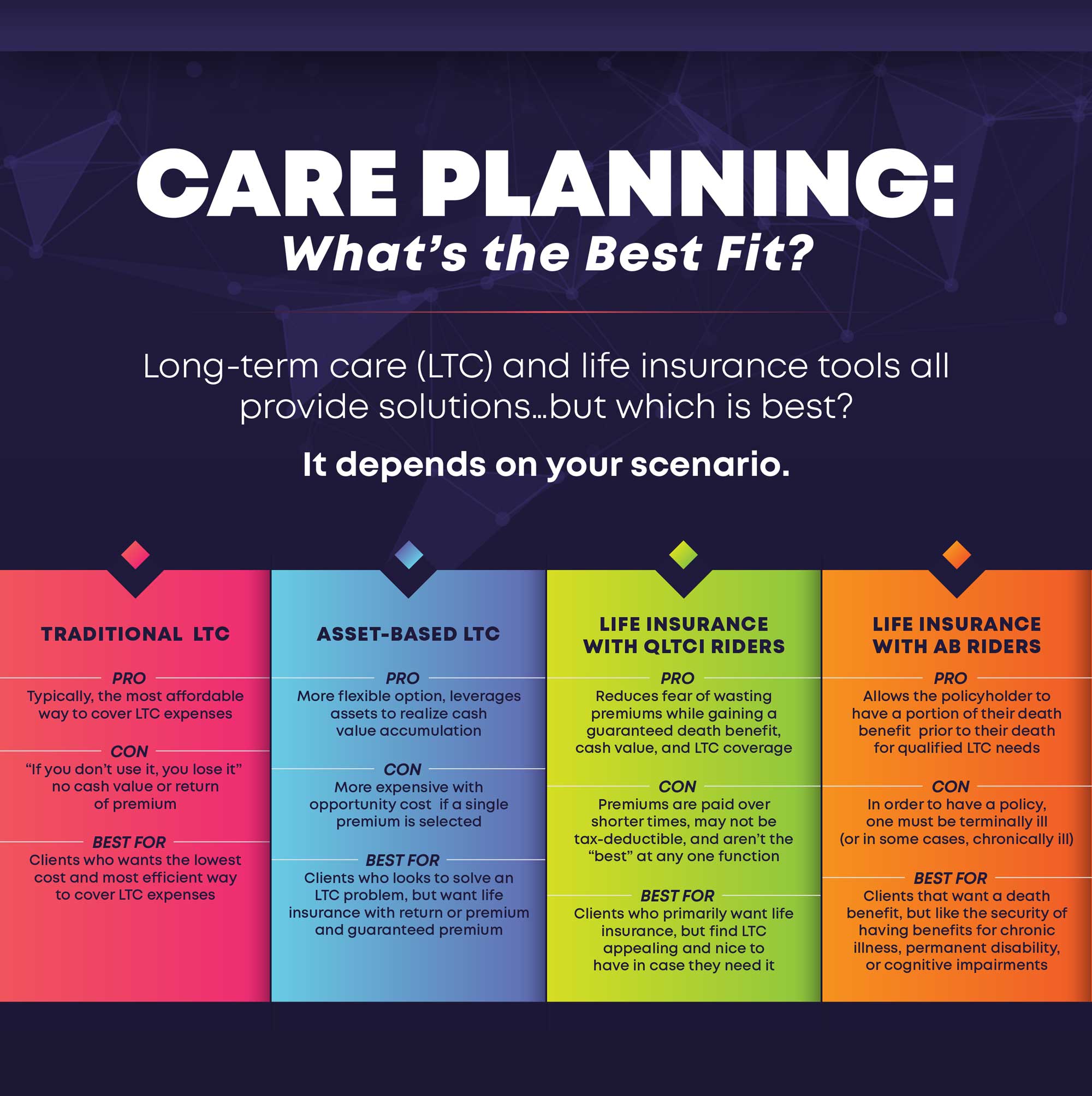

You never know what’s around the corner. We can help prepare you financially for long-term care services you may need so that a health crisis doesn’t derail your retirement savings. Considering that you may need to reduce your financial means before Medicaid will pay for long-term care, and neither your employer group health insurance nor major medical insurance will cover long-term care, planning ahead for these potential expenses is crucial.

Hollifield Financial Group serves as a vessel to help our clients maneuver Medicare and avoid the confusions and frustrations that come with senior health insurance. We can help evaluate your situation and determine if purchasing a long-term care insurance policy may be the right move to help you feel confident in your financial future.